With recent inflation increases and the Fed’s plans to keep raising short-term interest rates to help manage that inflation, some of you may be looking for alternative ways to weather the storm. A Series I Savings Bond may be one option you’re seriously considering if you haven’t already done so. Many investors are finding them attractive since they offer a rate of return plus inflation protection that’s backed by the U.S. government, even with certain purchase limits, restrictions, and tax treatments to keep in mind.

Several of you have asked me about Treasury I Bonds these last several months, and it’s been a recurring topic throughout our Ladies’ Summer Luncheon and Happy Hour Series. With certain deadlines approaching, I wanted to once again bring it to your attention. If I Bonds are something you’re still interested in adding to your investment portfolio, you may not want to miss the opportunity to do so, especially with the short window that’s left to buy them at the current rate. According to a recent Barron’s article, now until the end of October may be a good time to invest, since they may become “less attractive” this coming November when a new rate for them is set. “Individual investors may want to snap up the inflation-linked I bonds before the end of October to get the current 9.6% interest rate for the first six months [after purchase]. The new rate, applying to bonds purchased in November, is likely to be closer to 6%, Barron’s estimates, based on the formula used by the U.S. Treasury to calculate the semiannual rate.”(1)

How I Bonds Work

I Bonds, issued by the federal government and are purchased at face value to be held for up to 30 years and carry a zero-coupon interest rate. They’re also adjusted each year for inflation. The variable return will sit at 9.62% through end of October 2022.(2) According to Smart Asset, “Interest is paid on a monthly basis and compounds every six months.” Here are a few more details to keep in mind: (3)

- You cannot cash the bond until after the first year of purchase.

- If you want to cash the bond after Year 1 but before Year 5 of your purchase, this would be considered an “early redemption” and you would forfeit interest payments for the previous three months.

- Once you’ve held the bond for 5 years, there’s no penalty to cash it.

- After 30 years, the bond stops paying interest.

$10,000 limit Loopholes

There is a $10,000 limit per year for Treasury I Bonds that can be purchased per year. This is per entity not per individual. (4) However, there are ways to work around this if you want to invest more to capture that 9.62% yield. Some of these loopholes may be through tax refunds, family members, or businesses and trusts, or tax refunds. (5)

If you’re an entrepreneur or business owner, you can invest an additional $10,000 in your company’s name. Also, if you have a spouse or partner, they can invest $10,000 for themselves, as well as an additional $10,000 if they’re also a business owner. You can also gift your child or grandchild up to $10,000 in I Bonds. (6) If you have additional questions about these loopholes, please give CBFS a call.

How to Set them Up

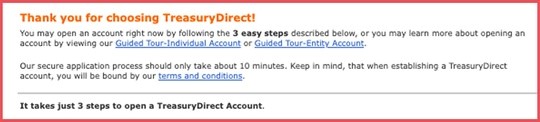

I Bonds are pretty simple to set up. You can go to TreasuryDirect.gov and open a free account to purchase these federally-backed securities directly from the U.S. Treasury.(7) Here’s how to get started.

1. Gather your info. Make sure you have the following close at hand: your taxpayer identification number, current address, checking or savings account information, and email address.

2. Go to Treasurydirect.gov’s account creation page. Navigate to the bottom of the page and select “Apply Now” on the left. This will begin your account creation journey. Next, you will choose between an Individual or Entity account. Select Individual account type (it’s the default option) and click “Submit.”

3. Enter your info. Using the information gathered in step 1, fill in the fields requested and check the box at the bottom to certify your Taxpayer Identification Number. Click “Submit.”

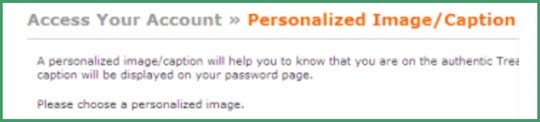

4. Select a personalized image. Take some time here to select an image and caption you will remember. Think of this as a visual password for your account. Click “Submit.”

5. Secure your account. Select your password and security questions on this screen. Make sure the answers to your security questions are impossible to guess but easy to remember. Click “Submit” to move to the final step.

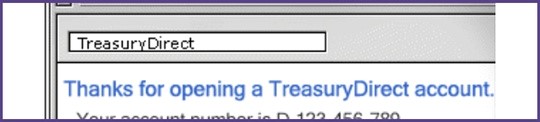

6. Check your email. Finally, look for your TreasuryDirect account number in your email. You’ll need this to log into your account later.(8)

You can begin purchasing I Bonds now that you’ve created your account. Remember, I Bonds earn interest for 30 years unless you cash them in. You can do this after a year has passed from the time of purchase, but you’ll lose the previous three months of interest. However, there is no penalty if you let them mature for five years or more. The maximum amount you can invest is $10,000 total per calendar year.(9)

Do you have questions about I Bonds, or anything else financial? Please reach out anytime. We’re here to help!

1. Barrons.com, Sept 19 2022

2. Smart Asset, financeyahoo.com, Sept. 20 2022

3. Smart Asset, financeyahoo.com, Sept. 20 2022

4. Bankrate.com, June 27, 2022

5. Smart Asset, financeyahoo.com, Sept. 20 2022

6. Treasurydirect.gov, 2022

7. Treasurydirect.gov, 2022

8. Treasurydirect.gov, 2022

9. Treasurydirect.gov, 2022

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Recent Comments