As an investor, you face another, lesser-known risk for which the market does not compensate you, nor can it be easily reduced through diversification. Yet, it may be the biggest challenge to the sustainability of your retirement income.

This risk is called the sequence of returns risk.

The sequence of returns risk refers to the uncertainty of the order of returns an investor will receive over an extended period of time. As Milton Friedman once observed, you should, “never try to walk across a river just because it has an average depth of four feet.”2

Timing, Timing, Timing

The sequence of returns risk is especially problematic while you are in retirement. Down years, in combination with portfolio withdrawals taken to provide retirement income, have the potential to seriously damage the ability of your savings to recover sufficiently, even as the markets fully rebound.

If you are nearing retirement or already in retirement, it’s time to give serious consideration to the “sequence of returns risk” and ask questions about how you can better manage your portfolio.

EXAMPLE:

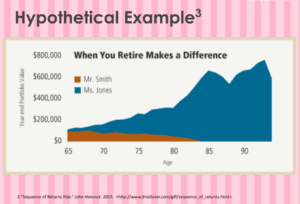

Scenario 1:

Mr. Smith retired in 2008, at the beginning of the Great Recession, during a period of time when the markets experienced a significant downturn. Mr. Smith started making 4% annual withdrawals from one of his retirement accounts, which held $200k in funds. Since retiring in this difficult time, the money he invested in his retirement account was hard-hit and was spent down much sooner than he had planned. The account did not have the opportunity to grow or recover because he needed to continue taking out income. The 4% withdrawal of the $200K, or $8000 withdrawal annually, meant that Mr. Smith had to sell more shares to account for the decrease in the account balance. He consequently spent down the account at a quicker rate than he had anticipated.

Scenario 2:

Ms. Jones also retired at 65, and she started out with the same $200K in one of her retirement accounts. However, in her case, she retired in 2013, during an extended period of growth in the markets. She also made 4% annual withdrawals, but since she began her withdrawals during a boom period in the market, her account not only provided her the ongoing income for which she had planned but the investments also grew during this period at a higher rate than 4%.

Both Mr. Smith and Ms. Jones retired at 65, each with $200K savings in one of their retirement accounts, but they retired during different periods of the market cycle. One of them began their retirement during a downturn (the Great Recession) and the other during a time of growth and expansion. As a result, one retiree depleted his savings and the other grew hers.

Taking withdrawals from a traditional portfolio exposes fixed-income investors to “sequence of returns” danger. In other words, experiencing negative returns early in one’s distribution phase (retirement) can deplete your portfolio more quickly than

planned and potentially undermine the sustainability of your assets. So you may want to consider a couple of strategies to help mitigate this concern.

Liquid Assets

The first is to have a pool of very liquid assets to fund two-to-three years of retirement spending; this may keep you from selling longer-term assets at an inopportune time. Through time, and depending upon market conditions, you may have the opportunity to replenish this cash reserve using gains from your retirement portfolio.

Annuities

Another complementary strategy is to integrate annuities. This can help shift the risk of market volatility off your shoulders and onto the issuing insurance company. 3

Until retirement, portfolio optimization largely focuses on the blending of different asset classes in the appropriate measure to create optimal portfolios. But in retirement, investors must integrate different retirement investment vehicles to enhance income and manage risk.

Annuities can help provide another stream of income in retirement. Depending on your choice, an annuity may help you mitigate the risk of outliving your assets, generate a guaranteed income for life or for a specific period of time, provide steady income with fixed payments, or offer income growth potential with variable payments. 4

A successful retirement is so much more than undertaking sound investment strategies. It also requires understanding “sequence of returns” danger and taking measures to mitigate the risk.

1. Diversification is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline.

2. 2. Quotefancy.com, 2021

3. The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities have contract limitations, fees, and charges, including account and administrative fees, underlying investment management fees, mortality and expense fees, and charges for optional benefits. Most annuities have surrender fees that are usually highest if you take out the money in the initial years of the annuity contact. Withdrawals and income payments are taxed as ordinary income. If a withdrawal is made prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies).

4. https://www.massmutual.com/efiles/ann/pdfs/an7567.pdf

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Copyright 2021 FMG Suite.

About

Cheri Blair is a financial planner and the founder of Cheri Blair Financial Services, where she provides client-centric financial planning services that equip and motivate her clients to pursue financial independence. With 25+ years’ experience, Cheri uses a relationship-based approach to help individuals and small business owners build a financial plan customized to their life situation, goals, and vision for themselves and their businesses. Because of her own financial journey, Cheri knows firsthand why it’s so essential for women to not only understand their finances but also feel empowered and confident when making their financial decisions. In addition to her one-on-one work with her valued clients, Cheri also provides informational seminars and workshops to further her mission of educating, supporting, and inspiring women with financial literacy. To learn more about Cheri, connect with her on Facebook and LinkedIn.